What Is Your ICB Credit Rating?

Today we know what Google says about us, how it ranks our business, we may know our Klout Score … or not! But do we know what our Credit Rating is? The Irish Credit Bureau (ICB), is currently the main source of credit reference for individuals in Ireland. The main financial institutions record all Bank accounts and Credit Cards with the ICB and it holds a record of the loan, balance and the monthly payment record. This database includes information on a wide range of loans, including personal loans, mortgages and credit card loans.

While the ICB does not make a decision whether or not you get a loan, the Financial institutions use the information held by the ICB when making the decision to approve the loan or not.

What Does The ICB Database Include?

The ICB’s database holds information about you if you have had an active loan in the past 5 years and if your lender has provided information to the ICB. The information is held in an individual credit report. A sample ICB Report can be found here.

The ICB report includes:

– Your name, address, date of birth,

– Name of lender , amount of loan, term and loan account number for all loans active within the last 5 years,

– Records repayments made or missed for each month, this is shown by a series of letters as explained below.

– Any outstanding balance or Failure to clear off any loan,

– Loans that were settled for less than you owed and,

– If the Lender took and Legal action against you.

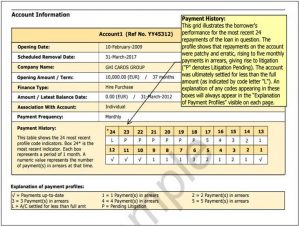

Below is what the repayment on a loan look like. If you make a full instalment payment on time this is noted by a tick, if you are one month in arrears this is shown by a 1, two months by a 2 ect.. If the loan is pending litigation this is shown as a P, and if you settle for less than the full amount of the loan this is shown as a L.

Irish Credit Bureau Report

If you have a very bad rating from one or more loans, you can repair this by making the full instalment payment on time with subsequent loans.

Your Credit Scoring

The ICB calculates a credit scoring based on your credit report if a lender requests it. A high score indicates a good record and a low score indicates a poor repayment record.

The Irish Credit Bureau requires your consent for it to provide information on your credit history however it is normal practice that such consent is part of any loan agreement. You have the right to access this information under data protection legislation.

You can obtain a copy of your credit record by completing the Irish Credit Bureau’s application form or applying online (see www.icb.ie) – a cost of €6 arises.

Further Information:

www.icb.ie Gives full information and how to apply for a copy of your Credit Report.

www.citizensinformation.ie has a detailed page on ICB and your rights.

If you are restructuring or looking at implementing a restructure plan as a Company or individual get in touch with us at Regan Solicitors. You call us on 01-6874100 or fill our our contact form and we’ll be in touch shortly. We are located in Dublin 2 and Rathfarnham.